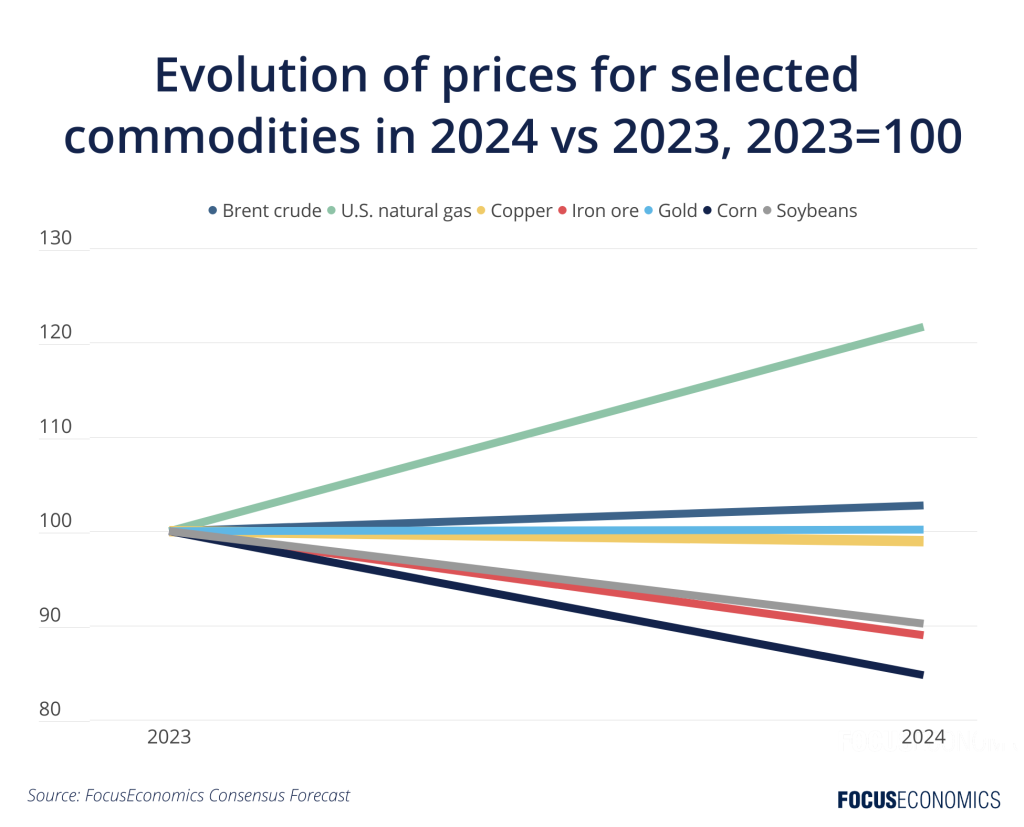

Discover the future of global commodities in 2024 as we navigate the dynamic landscape of energy, wiring metals, precious metals, and agriculture. Our expert analysts unveil key thingamabob forecasts, offering insights that span from rising energy prices to the soft-hued wastefulness well-expressed copper’s short-term outlook.

Energy Price Forecast 2024

Our consensus for the energy price forecast of 2024 is that energy prices will stereotype virtually 2% higher in 2024 than in 2023. This is mainly due to higher oil prices, which should be supported by ongoing OPEC cuts and stronger economic momentum in China—our panelists expect Brent transplanted oil to stereotype at USD 86 per whisk next year. Gas prices are moreover forecast to rise, boosted by higher U.S. LNG exports and tight Russian gas supply. In contrast, coal prices are forecast to fall as countries increasingly shift to cleaner fuels.

Base Metal Price Forecast 2024

Softer economic growth in some key ripened markets will see wiring metal prices stereotype 3% lower in 2024 compared to 2023, equal to our panelists. This will be partly offset by a likely uptick in economic momentum in China—the world’s largest consumer of most wiring metals—with remoter Chinese stimulus measures a key upside risk.

Precious Metal Price Forecast 2024

Precious metal prices are projected to be largely stable in 2024 from 2023. A slightly weaker U.S. dollar and rate cuts by global inside banks will provide support to all precious metals. Moreover, silver will goody from expanding electric vehicle and solar energy markets and platinum will proceeds ground due to the ongoing shift yonder from palladium in vehicles. That said, lower inflation will provide downward pressure, given precious metals are often seen as a hedge versus upper prices.

Agricultural Price Forecast 2024

Our analysts expect agricultural prices to stereotype virtually 8% lower in 2024 compared to this year. The easing of drought conditions in Argentina and Uruguay will uplift global grain supply, while Ukraine will gradually build volitional trade routes to overcome the expiration in July of the Black Sea Grain Initiative with Russia. Export restrictions in emerging markets, the wrongheaded impact of El Niño and an intensification of the Russia-Ukraine war are upside risks.

Insights From Our Expert Analysts

On oil, EIU analysts said:

“The global oil market is set to remain extremely tight in 2024. We expect Saudi Arabia to observe the reduced production quotas that it has well-set with its partners in the OPEC group of oil exporters until the end of the first quarter of 2024. The country is moreover unlikely to increase output markedly over the rest of that year.”

On copper, ING’s Ewa Manthey said:

“Although in the longer term, the outlook for copper remains bullish considering of its key role in the energy transition, for 2024, it will be the supply and demand wastefulness that will momentum the copper price, with lagging Western demand and surging Chinese production dampening the outlook in the short-term.”

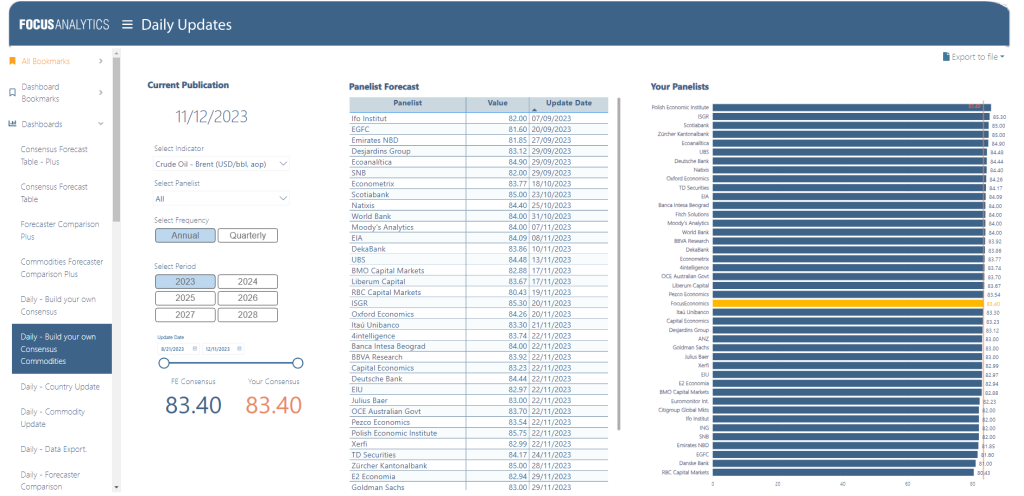

The latest commodities price projections at your fingertips with daily forecast updates

Unlock the potential of this compelling new full-length by taking wholesomeness of a complimentary demo or self-ruling trial. Delve into the wits and discover firsthand the valuable insights it brings to the world of commodities.

.avif)