The VA Tech Wabag share price is a hot point for numerous speculators. It's more than a fair number. It tells a story about a company in the pivotal commerce of water.

VA Tech Wabag is a pioneer in water treatment. They construct and oversee plants that clean water for cities and businesses. This makes the company basic. But what makes its stock move?

This article will break it down. We will investigate the components that drive the VA Tech Wabag share price. You'll get a clear view of its past, display, and future potential.

What Does VA Tech Wabag Do?

To get it in stock, you must begin with getting it in the business.

VA Tech Wabag is an Indian multinational company. Its center work is water treatment. This includes:

-

Designing treatment plants.

-

Building them (EPC contracts).

-

Operating and keeping up with them (O&M).

Simply put, they turn contaminated water into clean, usable water. This is an imperative benefit. The request for clean water is continuously developing. This solid trade establishment underpins the VA Tech Wabag share price.

How Trade Fragments Influence VA Tech Wabag Share Price

The company's work is divided into two fundamental parts. Both play a part in forming the VA Tech Wabag share price.

-

The Ventures Division: This is where the huge bargains happen. Wabag wins huge contracts to construct treatment plants. These ventures bring in major income. A developing list of unused orders is an exceptionally positive sign for investors.

-

The O&M Division: This is the long-term diversion. Here, Wabag works the plants it builds. This gives an unfaltering, dependable pay stream. It builds solid client relationships.

A solid blend of huge ventures and steady O&M work makes certainty. This certainty specifically boosts the VA Tech Wabag share price.

Read Also:- Top 10 Eco-Friendly Tech Products for Students in 2025

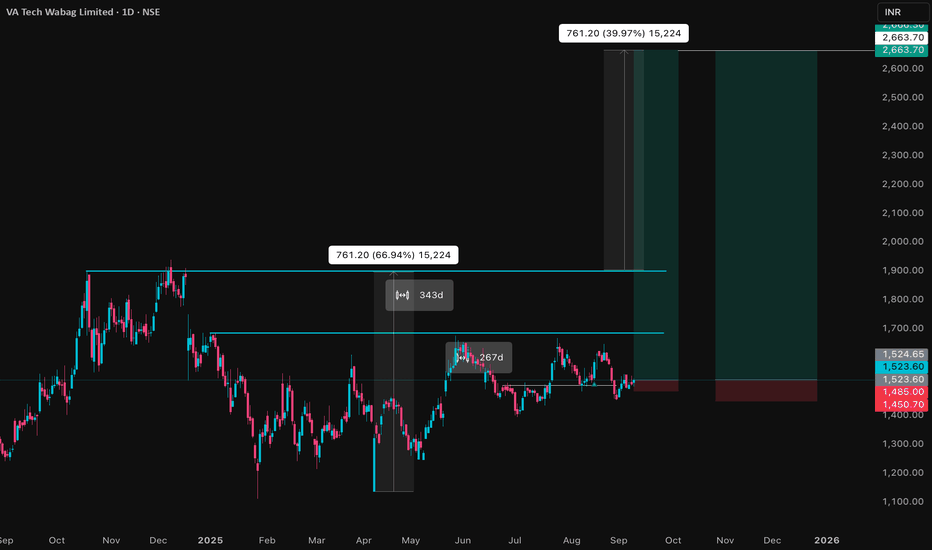

See Back: The History of VA Tech Wabag Share Price

The VA Tech Wabag share cost has seen numerous ups and downs. Its travel has been exciting.

-

The Development Stage: After its stock showcase made a big appearance, the company inspired financial specialists. Winning huge contracts, particularly overseas, frequently drove sharp rises in the VA Tech Wabag share price.

-

The Extreme Times: The stock, moreover, confronted challenges. Venture delays, showcase slowdowns, and occasions like the COVID-19 pandemic harmed its widespread execution. Amid these times, the VA Tech Wabag share cost felt the pressure.

-

The Later Comeback: Of late, the story has been positive. Government activities like the Jal Jeevan Mission have made a difference. Unused rules on wastewater treatment have made more openings. This has driven a new wave of positive thinking around the VA Tech Wabag share price.

What Moves the Stock? Key Variables for VA Tech Wabag Share Price

Many components impact the VA Tech Wabag share cost. We can bunch them into two categories: inside and external.

Internal Drivers of VA Tech Wabag Share Price

These are components inside the company's control.

-

The Arrange Book: This is the most vital driver. A huge and developing arrangement book implies more future income. When Wabag reports an unused huge contract, the VA Tech Wabag share cost frequently bounces up immediately.

-

Financial Wellbeing: Quarterly come-about are report cards. Speculators see income, benefits, and obligation. Solid comes about through constructing belief and can thrust the VA Tech Wabag share price higher. Powerlessness can do the opposite.

-

Management's Vision: What the company pioneers say about things. If they express certainty about the future, financial specialists tune in. Positive direction can be a capable catalyst for the stock.

External Impacts on VA Tech Wabag Share Price

These are exterior components that still have an enormous impact.

-

Government Arrangements: Wabag's victory is tied to government investing. Approaches to clean water, stream cleaning, and natural rules make trade. More government centers imply a way better viewpoint for the VA Tech Wabag share price.

-

The By and Large Economy: The stock advertisement is associated with the economy. In a developing economy, with more mechanical movement, Wabag flourishes. In a lull, ventures can get stuck, harming the stock.

-

Competition: Wabag must compete for ventures. Its capacity to win contracts with great benefit edges is key. Its innovation and execution aptitudes offer assistance that stands out.

-

Global Components: Wabag works in numerous nations. Issues like political insecurity or money changes in those districts can influence profits.

What’s Following? The Future of VA Tech Wabag Share Price

The future of the VA Tech Wabag share cost looks promising. A few effective patterns are working in its favor.

-

ESG Contributing: "ESG" stands for Natural, Social, and Administration. Water is a central natural issue. Reserves that center on feasible contributing are buying stocks like Wabag. This can lead to a long-term rise in the VA Tech Wabag share price.

-

Water Shortage: The world is running short of clean water. This is a pitiful truth. Companies that give arrangements, like Wabag, have become more valuable.

-

The Circular Economy: The future is almost reusing wastewater. Wabag has the innovation to make this happen. This opens up a tremendous modern market.

However, potential remains fair potential without activity. The company must execute its plans well. Changing over its arranged book into unfaltering benefits is the extreme key to a rising VA Tech Wabag share price.

Read More:- Role Of Tech In Enhancing Data Privacy

Final Considerations: Is VA Tech Wabag Share Price Worth Watching?

In conclusion, the VA Tech Wabag share price is a reflection of a crucial trade exploring a complex world. It offers a one-of-a-kind chance to contribute to the water sector.

The stock has dangers, like any other. But the long-term story is solid. The requirement for clean water will never go away.

For shrewd financial specialists, observing the VA Tech Wabag share price implies observing the company's arrangement book, how money comes about, and the worldwide water story. Do your inquiry about it, get to the dangers, and you might discover a profitable opportunity.